All Categories

Featured

[/image][=video]

[/video]

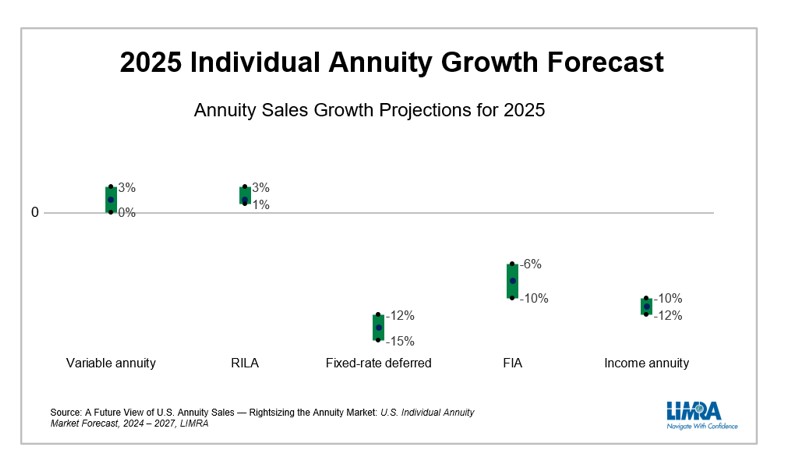

In 2025, LIMRA is projecting FIA sales to drop 5%-10% from the document established in 2024 however remain over $100 billion. RILA sales will certainly note its 11th consecutive year of record-high sales in 2024.

LIMRA is forecasting 2025 VA sales to be degree with 2024 outcomes. After record-high sales in 2023, revenue annuities propelled by engaging demographics patterns and eye-catching payment prices ought to surpass $18 billion in 2024, establishing an additional document. In 2025, lower rate of interest will certainly oblige service providers to drop their payment prices, leading to a 10% cut for earnings annuity sales.

It will be a blended overview in 2025 for the overall annuity market. While market conditions and demographics are extremely favorable for the annuity market, a decrease in rate of interest rates (which pushed the remarkable development in 2023 and 2024) will certainly undercut fixed annuity products continued development. For 2024, we anticipate sales to be more than $430 billion, up between 10% to 15% over 2023.

The company is likewise a hit with representatives and consumers alike. "They're A+ ranked.

The company sits atop the most recent version of the J.D. Power Overall Customer Fulfillment Index and boasts a strong NAIC Issue Index Score, also. Pros Market leader in customer satisfaction Stronger MYGA rates than a few other extremely ranked companies Cons Online item info could be more powerful More Insights and Professionals' Takes: "I have actually never had a disappointment with them, and I do have a number of pleased clients with them," Pangakis stated of F&G.

The business's Secure MYGA includes advantages such as motorcyclists for terminal health problem and nursing home arrest, the capacity to pay out the account value as a fatality advantage and prices that go beyond 5%. Couple of annuity firms stand out greater than MassMutual for customers that value economic strength. The firm, established in 1851, holds a prestigious A++ ranking from AM Best, making it one of the safest and greatest firms readily available.

Single Payment Deferred Annuity

Its Steady Trip annuity, for instance, gives a conservative way to produce income in retired life coupled with manageable surrender charges and numerous payment choices. The company likewise advertises registered index-linked annuities through its MassMutual Ascend subsidiary.

"Nationwide stands out," Aamir Chalisa, basic supervisor at Futurity First Insurance coverage Team, told Annuity.org. "They've got impressive customer support, a very high ranking and have been around for a number of years. We see a great deal of customers requesting for that." Annuities can offer considerable value to possible clients. Whether you wish to generate revenue in retired life, expand your cash without a great deal of threat or make use of high prices, an annuity can successfully achieve your goals.

Fixed Annuity Rates New York

Annuity.org established out to recognize the leading annuity firms in the sector. To achieve this, we created, examined and implemented a fact-based methodology based upon crucial sector factors. These include a business's monetary stamina, accessibility and standing with clients. We likewise got in touch with numerous industry experts to obtain their takes on different firms.

Latest Posts

Single Premium Deferred Fixed Annuity

Talcott Annuities

Ibew Local 58 Annuity Fund